GNUS stock is the stock of Genius Brands International, a company that is in the entertainment business. Its parent company is A Squared Entertainment, which was formed through a merger. Its CEO is Andy Heyward.

GNUS’s most recent earnings

GNUS stock is a leading global kids’ media company that produces Stan Lee’s Superhero Kindergarten. In addition, it markets and licenses Genius Brands’ IP to lead partners and is in partnership with Alibaba.

GNUS is also a player in the branded children’s entertainment space, focusing on llama Llama Llama Llama llama Llama Llama, llama Llamadonna Garner, and Llama o’ ring. The company is also the home of the aptly named Genius Brands International, Inc. The stock is trading in a range of 0.59 to 0.84. Its last reported earnings were on August 17, 2022, before the market opened. It also held a conference call for investors at noon Eastern on the same day. The company also aptly named its website “Genius.”

The best part about the company is its commitment to excellence, from its high-quality products to its stellar customer service. Its stock also demonstrates the company’s commitment to innovation by utilizing technology to deliver products and services to customers across the globe.

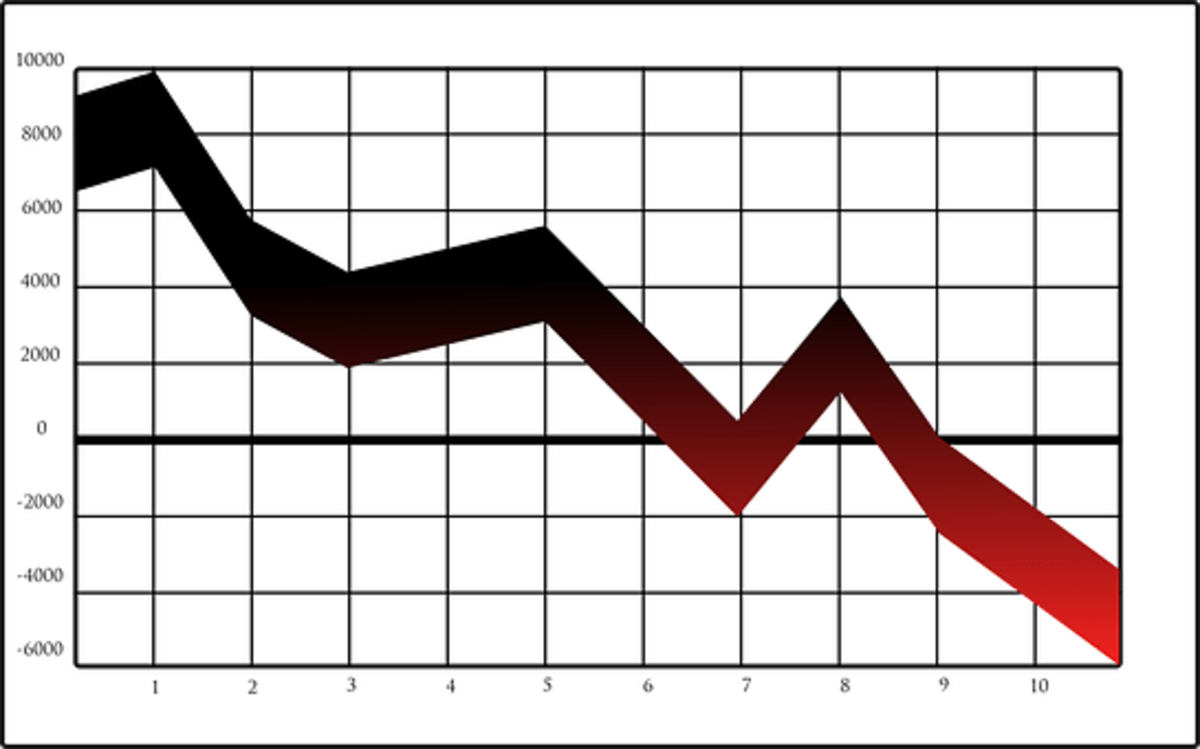

GNUS’s sentiment reading

GNUS is an entertainment company that produces and distributes multimedia content for toddlers to tweens. Its production services are the most significant contributor to revenue. It also offers a subscription service called Kidaverse. The company also partners with technology firms. In addition, GNUS is working on major product launches.

The company has been able to grow from a small base. Its growth has been inorganic. It has acquired Wow!, a media and information services company, which has provided the company with a margin of safety. The company’s production services include launching a new subscription service, Shaq’s Garage, in Q4 ’22. It has also launched the Kartoon Channel on Roku and Pluto TV.

The company has been pushing Kids’ content expansion. Its most significant contribution to revenue was from production services, but it’s also offering Rainbow Rangers. It’s also working on collaborative projects. It’s planning to launch a subscription service for children called Shaq’s Garage in the fourth quarter of ’22. It has a large operating footprint. Its content is engaging and authoritative.

GNUS’s price target

GNUS’s price target is a number that is calculated by averaging analyst projections for the stock. To come up with a price target, analysts conduct a lot of research, listen to the company’s conference calls, and interview the company’s executives. This data is then used to create a forecast for the stock price. If the forecast is optimistic, the company’s share price is expected to increase. If it is negative, the store is expected to go down.

The price target is a great way to determine whether a company’s stock is worth investing in. It is beneficial when a stock is moving up rapidly. The price target should be combined with other traditional price prediction techniques. When the price of a stock is predicted to go up, investors should take advantage of any profits they make when they sell their shares.

If the price of GNUS’s stock is forecast to go down, it is a bad buy. The cost of GNUS’s stock could be as low as 2.00 at this point, which is not a good time to invest.