Where to find the Best Auto Insurance For a Typical Car – Tips For Getting Cheap Antique Car Insurance

Can you find the best auto insurance for a typical car? Is it even achievable to find cheap antique motor insurance? Classics cars can be very worthwhile, sometimes high cost of servicing and storage – to become alarmed to have to pay more for an insurance plan than necessary. Read on to master some things you should know before deciding to purchase a classic car automobile insurance policy.

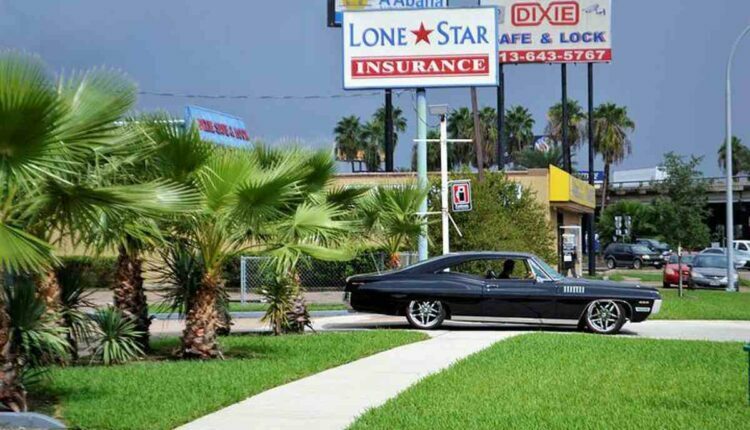

Who hasn’t converted their head while using the road to get a better check out a classic or collectible automobile? We’re enamored with the collections of the car as well as it is pristine condition. But the in-depth attention to maintaining a vintage car’s flawless appearance and operation is not only to pull admiring looks, it is also essential to keep up the market value in the car. For this reason, along with other folks, specialized classic auto insurance insurance policies were developed to meet the wants of classic and valuable car owners.

Another reason (a very important reason) for guaranteeing your vehicle as a classic as well as a collectible is the greatly reduced price of classic car insurance relative to typical auto insurance. Standard auto insurance could cost as much as 200%-300% more than basic auto insurance. So, what is the major factor that causes such a good disparity in price between basic auto insurance and standard insurance? Generally, collector vehicles usually are driven on a limited time frame (the garage is everywhere they are usually found). As a result, the unfortunate risk of accident and loss to help collector vehicles is drastically lower than the risk involved in regularly driven autos.

DO YOU HAVE A VEHICLE QUALIFY?

The following is a directory of classifications for collectible cars and trucks.

Antique cars – more than two decades or older

Custom cars and trucks – 1949 to present

Basic cars – 20-24 yr old

Collectible cars – 15-19 years old

Exotic cars instructions less than 15

Street the fishing rod – Pre-1949

This is the typical listing for those cars that happen to be considered eligible for classic car or truck auto insurance. Still, certain cars and trucks may be accepted at the foresight of the insurer. Basic car insurers sometimes individualize an insurance policy for a particular vehicle.

UNDERSTAND THE RESTRICTIONS ASSOCIATED WITH COLLECTOR AUTO INSURANCE?

Certain application limitations are placed on the guaranteed vehicle to keep collector insurance rates low.

It cannot be used for day-to-day use. These rules are available using it to drive to work, function errands, or go out while using bite to eat. Under an antique car insurance policy, car usage really should be limited to driving to in addition to from car shows along with the occasional parade.

Cannot be motivated more than 2 500 a long way per year. 2 500 is a fairly standard number between insurance companies that offer classic insurance coverage, but some insurance companies have mileage plans that enable up to 5 000 or perhaps 6 000 miles annually. This increased mileage reduction was implemented to accommodate these drivers who like to take their particular cars to distant automobile shows. Of course, the monthly premiums are greater.

Must be retained in a locked garage. Any locked, enclosed trailer may also do, but a carport will not meet the grade, although you may live in a gated neighborhood with a security guard. (The climate is also an enemy of the car). Some policies may stipulate that a car is not left unattended in a building. Leaving your car inside a motel or hotel building might present a problem.

JUST WHAT CONSIDERATIONS SHOULD BE KEPT IN MIND? THINK ABOUT CLASSIC AUTO INSURANCE.

Does the business offer Agreed on Value Insurance or Stated Value Insurance coverage?

Agreed value lets the vintage car owner and the insurance agent establish a value for the auto it does not necessarily reflect the market valuation for that car. Usually, the agent will have to do an extensive inspection of the car inside and out, all of which will require photos of the auto.

What are the usage and gas mileage restrictions?

Find the policy this best suits your plans to get using the car. Why spend on a plan that covers gas mileage for 5 000 after you know that you won’t even occur close to using the 2 000 miles available in a cheaper insurance plan?

Can you choose your mechanic shop?

The Mom and Pop purchase down the road might do a steady job on your regular car and provides the lowest repair bid in the city, but do you want these individuals working on your classic “baby”?

What company often underwrites the policy, and what is the standing of that company?

You want to be certain that the underwriter has an excellent track record and will be competent to fulfill all of their obligations regardless of whether there is a larger than usual influx of insurance says for some reason.

Are there any discount programs readily available?

A good insurance company should always show you any discounts available to your account, but it doesn’t hurt individuals.

Does your insurance offer insurance policies for classic or improved cars under development?

Some companies will display the progress that is being created on your vehicle while it with the garage for repairs and also modifications and allow you to modify the car’s value as the job continues. Also, this insurance policy covers damages to your automobile in case of a catastrophic incident such as a fire, the hydraulic lift fails, or the application cart falling on your automobile (with a little imagination, the number of choices is endless. )

EXACTLY WHY CAN’T I JUST ADD OUR COLLECTOR CAR TO THE LOVED ONES AUTO INSURANCE POLICY?

You can; nonetheless, it could be a costly mistake. When repairs are needed, you may be obligated to accept the lowest repair put money, or if the car is badly damaged, the insurance corporation could opt to have it totaled. And although a discount is frequently given for cars put together under one policy, that discount may not give the savings available if the automobile was insured under a vintage auto insurance policy.

Finally, make sure that your insurance company has a good comprehension of classic cars. If your car or truck is totaled, you want to manage to work with a knowledgeable representative and also receive the full value of your car.

COMPARE CHEAP TYPICAL CAR AUTO INSURANCE QUOTES ONLINE.

Read also: https://youthagainstsudoku.comcategory/insurance/.